Sébastien Lachaussée & Elisa Martin-Winkel

Cultural patronage & audiovisual works

As patronage is very often mentioned with regard to the funding of cultural businesses and products, it seems interesting for a producer or broadcaster to consider kind of funding and to linger on the applicable conditions.

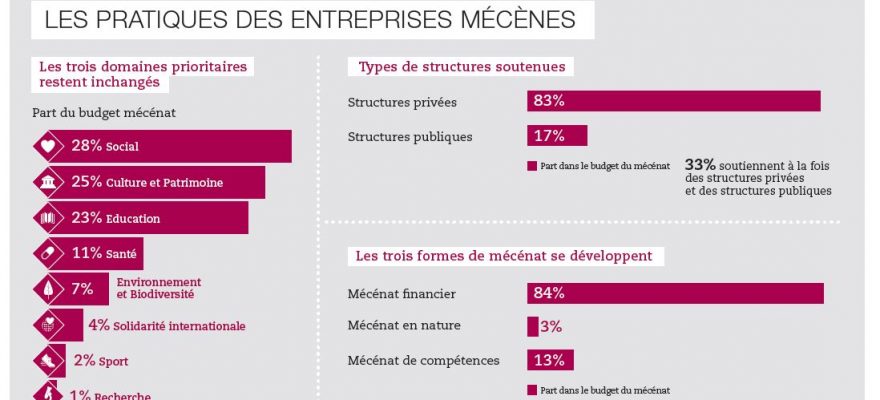

In general, patronage is defined as a donation, from a company or an individual, to an activity of general interest. This commitment can be financial, in kind or in skills, and concern many sectors, including the cultural sector.

From a French legal point of view, patronage is defined as « the material support provided, without direct compensation from the beneficiary, to a work or a person for the exercise of activities of general interest. » (Order of January 6, 1989 relating to economic and financial terminology).

This lack of retribution distinguishes patronage from sponsorship which is carried out by the sponsor for consideration, often for advertising purposes. Sponsorship is indeed defined « as material support given to an event, a person, a product or an organization with a view to obtaining a direct benefit from it. » (Order of January 6, 1989 relating to economic and financial terminology).

In France, the law of August 1, 2003 relating to patronage, associations and foundations came to allow the development of this mechanism, followed by various changes.

- Tax benefit for the benefactor

Patronage is encouraged by a tax benefit for the patron. In general, according to the finance law for 2020, for the enterprises, the tax reduction is equal to 60% of the amount of the donation up to 2 million euros of annual donations and to 40% of the amount of the donation made beyond.

There is also an annual ceiling for donations giving entitlement to the tax benefit established at € 20,000 or 0.5% of turnover excluding taxes, when the latter amount is higher. If the ceiling is exceeded, it is possible to carry over the excess tax reduction for the following five years.

We can note here that the alternative between a fixed ceiling and a percentage of turnover was established in 2019 and increased in the finance law for 2020, in order to encourage patronage from SMEs, which were previously limited by their low turnover.

In the case of individuals, they benefit from a reduction in their income tax equal to 66% of the sums paid, up to an annual limit of 20% of taxable income (art. 200- of the French general tax code). Again, if the 20% income ceiling is exceeded, the benefit of the reduction can be carried over to the next five years.

- Contributions

Patronage results in the payment of a donation in cash, in kind or in skills. Indeed, article 238 bis, 1 of the French General Tax Code specifies that companies can make donations in kind.

Donations in cash do not raise any particular difficulties, on the other hand donations in skills must be evaluated and the modalities of such evaluation are legally established.

Accordingly, if these donations in kind are made in the form of a free service, they must be valued at their cost price, that is to say the remuneration and related social charges.

This valuation is organized as follows: the cost price to be used in the basis of calculation of the tax reduction corresponds, for each employee made available, to the sum of their remuneration and social charges relating thereto within the limit of three times the amount of the ceiling mentioned in article L 241-3 of the French Social Security Code.

About the delivery of products, the valuation corresponds either to the value of the goods in stock, or to the cost price of the service purchased for the beneficiary or to the short-term loss in value observed, if it is of an asset for a property recorded in the fixed asset account. And if the property is fully depreciated, it does not result to a tax reduction.

Companies are also subject to a reporting obligation which varies according to their form, the VAT regime and the amount of the donations.

Finally, it should be remembered that donations must be made without consideration. However, the tax administration can admit the existence of a counterpart as soon as there is a very significant disproportion between the sums given and the valuation of the service rendered, that is to say being of a total value lower that 25% of the donation amount. In particular, it is recognized that a benefactor can associate its name with the financed project.

For individuals, institutional or symbolic counterparties and material counterparties are accepted as long as they do not present a marked disproportion with the amount of the donation paid, i.e. within the limit of 25% of the amount given and with a ceiling of 73 euros.

- Beneficiaries of the donations

The beneficiary of donations must fulfill various cumulative conditions: subject to restrictive exceptions, exercising his activity in France, exercising his activity in at least one of the fields of general interest, having a non-profit character and not operating for the benefit of a restricted circle of people.

In this respect, article 238 bis of the French General Tax Code specifies that “works or organizations of general interest having a philanthropic, educational, scientific, social, humanitarian, sporting, family, cultural or contributing to the enhancement of artistic heritage, the defense of the natural environment or in the dissemination of French culture, language and scientific knowledge are eligible”.

The cultural field is therefore one of the sectors concerned. We can notably remark that since the finance law for 2019, series festivals are now eligible for the tax systems in favor of patronage from individuals and companies (articles 200 and 238 bis of the French general tax code), just like film festivals.

The non-profit nature implies an in-depth study of the functioning of the entity: disinterested organization (absence of redistribution of profits, administration on a voluntary basis or within the limits fixed by the tax administration), product little or not taken into account by the lucrative sector, lower prices, no exercise in competition with companies in the lucrative sector or under conditions different from the lucrative sector…

In the field of culture, we can note that many favorable derogatory regimes have been put in place. We can especially mention the one applicable to live performances and exhibitions of contemporary art. The system concerns public or private organizations whose management is selfless, and whose main activity is the presentation to the public of dramatic, lyrical, musical, choreographic, cinematographic and circus works, or the organization of art exhibitions who can benefit from corporate sponsorship even if they are subject to VAT and other commercial taxes.

It should be noted that donations made for the benefit of natural persons (such as scriptwriters or directors, for example) do not entitle the donor to tax benefits.

Only entities and projects that meet the criteria of general interest are eligible for patronage and thus empowered to issue donation receipts. Also, before making a call for donations, it is necessary to verify that the criteria are met. In this sense, it may be wise to proceed to a « tax rescript procedure », that is to say a request for an opinion from the tax administration on the possibility for the entity to issue such tax receipts. Such procedure requires a legal and personal accompanying to maximize the chances of success.

In view of the above, patronage is to be considered in the context of the funding of cultural works and activities. However, it is necessary to carry out a study on a case-by-case basis, in the light of each project and to organize its activity in compliance with tax provisions. To do so, resort to a specialized law firm is highly recommended.

SHARE THIS ARTICLE

CONTACT

OUR OFFICES

INFORMATION

sl@avocatl.com

PHONE

+33.1.83.92.11.67

Address

11 rue Sédillot

75007 Paris

Follow us :

Newsletter

Please enter your e-mail :